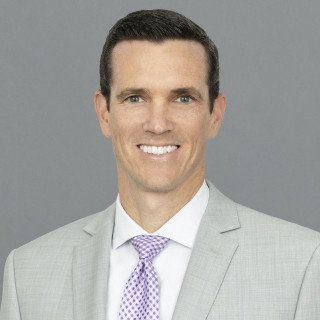

Mr. Bardwell’s practice focuses on all aspects of wealth transfer planning, including estate planning, charitable planning, business succession planning and post-death administration.

Mr. Bardwell routinely assists individuals and families in efficiently minimizing estate, gift and generation-skipping transfer taxes through the creation of wills, trusts, business entities and charitable organizations and the use of gifts, sales and other wealth-transfer strategies. He works closely with each client's team of advisors, including accountants, investment advisors and insurance agents, to ensure the client's personal planning and wealth preservation goals are accomplished in a coordinated manner. In addition, he advises clients on estate and trust administration, probate administration and the preparation of gift and estate tax returns. Mr. Bardwell has been designated as a Certified Specialist in Estate Planning, Trust & Probate law by the State Bar of California, Board of Legal Specialization.

In 2014, 2015, 2016, 2017, 2018 and again in 2019, Mr. Bardwell was named among the list of Southern California Rising Stars by Super Lawyers Magazine. Only 2.5% of the attorneys under age 40 in Southern California are selected for this honor.

While in law school, Mr. Bardwell served as a judicial extern to the Honorable Gary Allen Feess in the United States District Court for the Central District of California and as Literary Editor for the Pepperdine Journal of Business, Entrepreneurship & the Law.

- Pepperdine University School of Law

- J.D. (2008)

-

- California State University - San Diego State University

- B.S. (2005)

-

- Partner

- Jeffer Mangels Butler & Mitchell LLP

- - Current

- Attorney

- Freeman Freeman & Smiley, LLP

- -

- Attorney

- Lane Powell PC

- -

- Attorney

- WTAS LLC

- -

- Financial Management Network: Estate Planning Techniques, Financial Management Network, Inc.

- Southern California Chapter of the Appraisal Institute: Attorneys Working With Appraisers, Southern California Chapter of the Appraisal Institute

- Real Estate Tax Planning, Chapman Law School

- Speaking Engagement: NBI Business Institute: Estate Planning and Administration: The Complete Guide, NBI Business Institute

- NBI Business Institute: Tax Consequences of Trusts, NBI Business Institute

- Certified Specialist in Estate Planning, Trust & Probate

- State Bar of California, Board of Legal Specialization

- Rising Star

- Super Lawyers

- 2014-2019

- AV Preeminent Peer Review Rated

- Martindale-Hubbell

- California Bar Association

- Member

- Current

-

- Orange County Bar Association

- Member

- Current

- Activities: Trusts and Estates Section

-

- Orange County Estate Planning Council

- Member

- Current

-

- Washington State Bar Association

- Member

- Current

-

- King County Bar Association

- Member

- Current

-

- California

-

- Washington

-

- U.S. District Court, Central District of California

-

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation, Business Litigation, Franchising, Mergers & Acquisitions, Partnership & Shareholder Disputes

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Tax Law

- Business Taxes, Criminal Tax Litigation, Estate Tax Planning, Income Taxes, International Taxes, Payroll Taxes, Property Taxes, Sales Taxes, Tax Appeals, Tax Audits, Tax Planning

- English