(203) 635-8249Tap to Call This Lawyer

Badges

Claimed Lawyer ProfileQ&ALII Gold

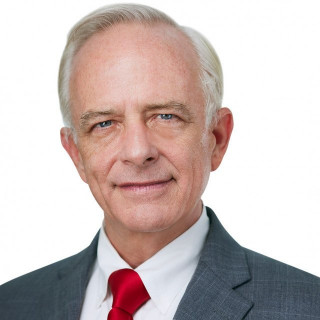

Biography

I am an experienced attorney and work diligently to provide my clients and their families with peace of mind. I handle Estate Planning and Probate matters throughout Connecticut and New York, and Tax Law matters worldwide.

Education

- New York University School of Law

- LL.M. (1991) | Taxation

-

- University of Connecticut School of Law

- J.D. (1985) | Law

- cum laude

-

- Duke University

- B.A. (1981) | Economics/History

- magna cum laude; Tobacco Road Magazine

-

- College of the Holy Cross

- Economics

- -

- Sailing Team

-

Professional Experience

- Principal

- Shea & Shea

- - Current

- Attorney Advisor

- U.S. Tax Court

- -

Publications

Articles & Publications

- APA's May Effectively Address Income and Expense

- Tax Notes International

Awards

- AV Preeminent Peer Rating

- Martindale

- 2011-2019

- 10.0 Superb Rating

- Avvo

Professional Associations

- Connecticut Bar Association

- Member

- Current

- Activities: Tax Law Section, Estates & Probate Section

-

- New York State Bar # 2435196

- Member

- - Current

-

Jurisdictions Admitted to Practice

- Connecticut

- State of Connecticut Judicial Branch

- ID Number: 303787

- -

-

- New York

- New York State Office of Court Administration

-

- U.S. District Court, District of Connecticut

-

- U.S. Tax Court

-

Fees

- Credit Cards Accepted

-

Rates, Retainers and Additional Information

Fixed Fees

Practice Areas

- Probate

- Probate Administration, Probate Litigation, Will Contests

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Elder Law

Languages

- English

Legal Answers

- Q. Transfer of deceased mother's vehicle without probate in CT.

- A: Provided that the vehicle and all other probate estate assets total less than $40k, an "Affidavit in Lieu of Probate" can be filed with the local probate court. There are 2 main forms for this simplified procedure: PC-212 and PC-212A. The car would then be divided between your mother's heirs, after satisfying or compromising with any known creditors. If you are the only child, then the court will issue a Decree ordering the car be transferred to you, which you can take to DMV, provided there are no unsatisfied creditors. An exception is available if your mother signed the beneficiary designation on the DMV registration, in which case you have 60 days from date of death to transfer ... Read More

- Q. I'm listed as beneficiary on a car registration, do I go to the DMV and claim it or does it need to go through probate?

- A: The car is not subject to probate and should not be listed on the probate inventory.

The title transfer is handled by Connecticut DMV.

The vehicle should however be listed on the CT estate tax return, which is typically filed as part of probate.

- Q. Which state to file probate case in?

- A: Your father's domicile controls, which is where he lived with an intent to return. If he has a CT condo, receives mail there and intended to return, then probate court for the town of his Connecticut residence would have jurisdiction.

Social Media

Websites & Blogs

- Website

- Shea & Shea Website

Contact & Map