Estate planning is not just for millionaires. You may not think you have an estate, let alone any need for a plan, but if you have children, if you have things of value, if you own a home, you need an estate plan. An estate plan ensures that you decide who gets your hard earned assets, whatever their size or value-- not the government. Without an estate plan, your wealth, your estate will pass according to the state intestacy statute. Don't you want to decide to whom and when your assets should be distributed and not a probate court?

Estate is planning how you direct to whom your property will be distributed and who will care for your minor children. Estate planning helps reduce tax liabilities, court costs, and attorneys' fees, and can minimize disputes after your death the loss of family members. We can also design your estate plan to deal with your possible future mental or physical incapacity, either through a trust or a durable power of attorney.

In addition, we can guide you through many situations that come up in everyday life that have a legal angle. Whether you are buying or selling a home, starting, buying or selling a business, switching jobs and need a severance or non-compete agreement reviewed, dealing with a minor criminal mater or have been injured in a car accident, you should have a lawyer you can turn to for advice. If we don't have the expertise to help you, we will find someone who does. The bottom line is that we want to be your lawyer.

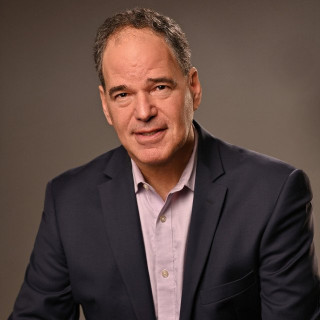

You have a family doctor (now they call them primary care physicians); you should have a family lawyer. If you want the benefit of a lawyer with over 38 years of far reaching experience, offering values-based, parent-centered estate planning, and a passion for helping clients, call or email Steve today.

- University of Connecticut School of Law

- J.D. (1986) | Law

- with honors, Moot Court Board

-

- University of Connecticut

- B.A. (1983) | Political Science

- magna cum laude, Phi Beta Kappa

-

- Principal

- Law Offices of Steven M. Basche, LLC

- - Current

- Partner

- Brown, Paindiris & Scott, LLP

- -

- Partner

- Hassett & Geoge, PC

- -

- Principal

- Law Offices of Steven M. Basche, LLC

- -

- Partner

- Jacobs, Walker, Rice & Basche, LLC

- -

- Associate

- Cohn & Birnbaum

- -

- Associate

- Schatz & Schatz, Ribicoff & Kotkin

- -

- Estate Planning 101, Connecticut Education Association Summer Conference, Mohegan Sun

- How can owners keep what they have earned, Exit Planning Exchange, XPX Hartford, Hartford CT

- The Importance of Special Needs Trusts, Parent Partnership, Adelbrook, Cromwell, Connecticut

- Planning Ahead: Are You Taking the Right Steps to Secure Your Retirement?, Estate Planning for Solo Practitioners

- Estate Planning Basics, CEA Summer Conference, Mohegan Sun

- AV Preeminent Peer Rating

- Martindale Hubbell

- 2012-2023

- 10.0 Superb Rating

- Avvo

- National Academy of Elder Law Attorneys

- Member

- Current

-

- Manchester Bar Association

- Member

- Current

-

- Connecticut Bar Association

- Member

- - Current

-

- Connecticut

-

- 2nd Circuit

-

- U.S. District Court, District of Connecticut

-

-

Credit Cards Accepted

Major Credit Cards Accepted -

Contingent Fees

Are available

- Estate Planning

- Guardianship & Conservatorship Estate Administration, Health Care Directives, Trusts, Wills

- Probate

- Probate Administration, Probate Litigation, Will Contests

- Elder Law

- Business Law

- Business Contracts, Business Dissolution, Business Finance, Business Formation, Business Litigation, Franchising, Mergers & Acquisitions, Partnership & Shareholder Disputes

- Real Estate Law

- Commercial Real Estate, Easements, Land Use & Zoning, Mortgages, Neighbor Disputes, Residential Real Estate

- English: Spoken, Written

- Q. Can executrix change locks on an empty estate house in CT?

- A: You can and should change the locks. One of the primary duties of the executor is to take control of the estate's assets. You should also check to see if there is insurance on the house.

- Q. Is TOD for car in CT a suitable approach to avoid probate?

- A: Designating a beneficiary for your car will keep it out of probate. DMV has a form you can attach to your registration. If you search CT DMV beneficiary designation, you should find that form. But you should know that having a will does not take your estate out of probate. Your will is your written instructions to the probate regarding how you want your estate distributed.

- Q. I'm one of 4 kids. My mothers estate has already been settled. Only I want to file wrongful death. Would only I benefit?

- A: Any recovery for wrongful death would be paid to the estate and would be divided up either according to the will or the laws of intestacy, not to you as the person who wanted to bring the action. The action would need to be brought by the executor or administrator.

- Website

- Website

Meet Steve Basche, Glastonbury Estate Planning Attorney

Meet Steve Basche, Glastonbury Estate Planning Attorney

Law Offices of Steven Basche

Law Offices of Steven Basche

Hartford Estate Planning Attorney Talks About Revocable Living Trusts

Hartford Estate Planning Attorney Talks About Revocable Living Trusts

Trust & Estates Lawyer Steven Basche explains why you need an estate plan.

Trust & Estates Lawyer Steven Basche explains why you need an estate plan.

Why I care about Estate Planning, and why you should too.

Why I care about Estate Planning, and why you should too.